In the UK, company fleet cars account for over 60 per cent of all new car sales – meaning that there are one million new fleet or business registrations every year.

With that in mind however, it’s important to realise that businesses can save thousands of pounds every year based on a car’s Benefit-in-Kind (BIK) rate – which takes into account a car’s value (P11D), its carbon emissions, and the type of fuel it uses.

As you might imagine, hybrid company cars receive a reduced BIK rate due to their lower CO2 emissions.

Ultra Low Carbon Vehicles (ULEVs) enjoy even lower rates, at five or nine per cent (depending on official emission rates). Battery electric cars are rated at five per cent.

You can find out more information about BIK rates, here.

Although there are many benefits when it comes to buying a green car for your business, the truth is that they haven’t always been popular, and there are common myths associated with ULEVS.

But which of them are true?

Dispelling common ULEV myths

They will never catch on

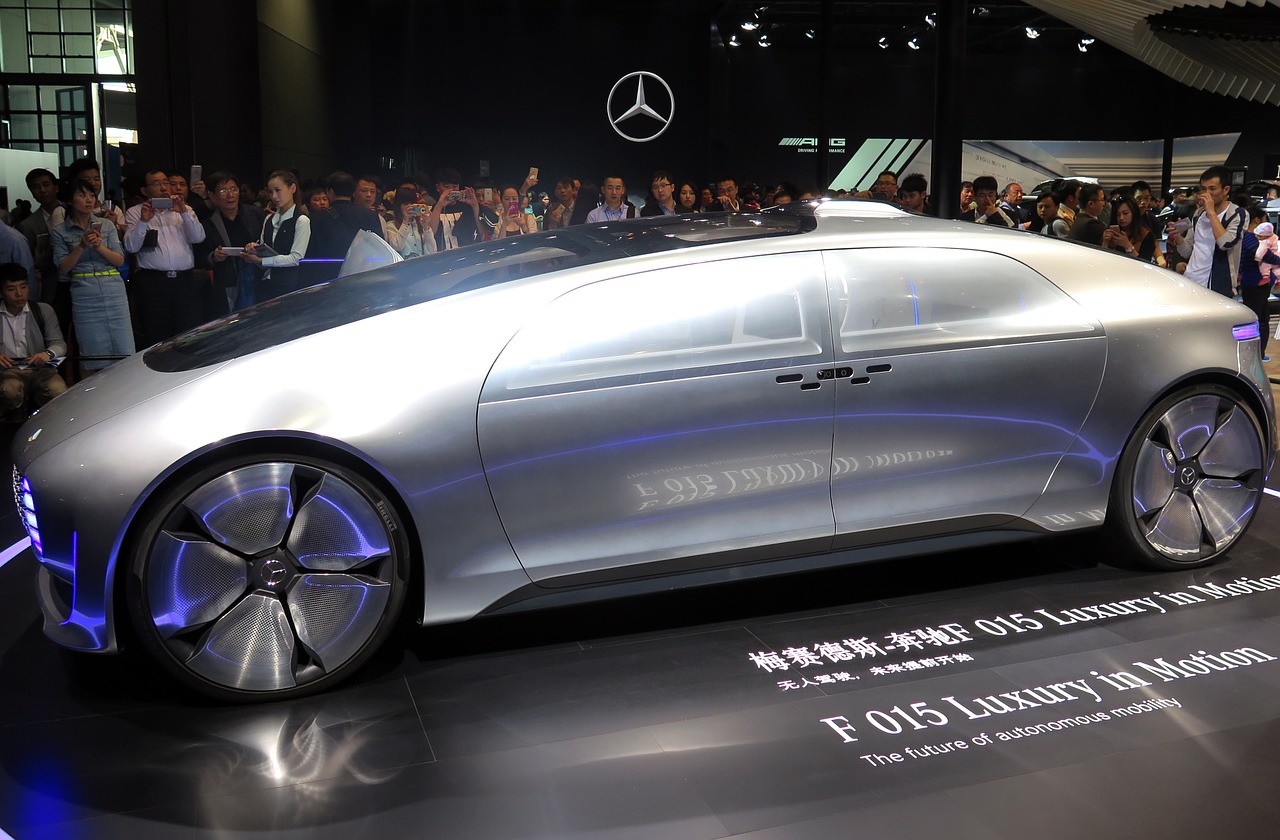

Every major car manufacturer currently operating in the UK has plans to bring a ULEV model to the market within the next five years. There is actually a full consensus in the automotive industry that electric vehicles (in their various forms) are the way forward for the automotive industry.

Furthermore, sales of ULEVs actually doubled from 2011 to 2012.

They are slower than other cars

Unlike combustion engines, electric motors generate maximum torque from zero revs, so they are actually very quick off the mark, and even manufacturers such as McLaren are beginning to rely more upon electric motors within their engines.

The fastest electric car in the world, the Zombie 222 by Blood Shed Motors can reach 60 mph in an incredible 1.7 seconds.

There is nowhere to charge an electric car

By the end of 2013, there were over 10,000 charge points across the UK, and in London, there are now more charging points than petrol stations.

Although it is common for people to fill up their car on a journey, research has found that this habit changes when someone buys a ULEV, as they are more likely to charge their vehicles in-between journeys, such as during the night or when at work.

They pollute more or just as much as a petrol or diesel car

This is quite possibly one of the most damaging, yet completely incorrect rumours about ULEVs. It is true that all cars generate pollution during their manufacturing, use and disposal – but their motors are much more energy efficient and this is where it counts.

Although it is also true that at some points, a car will receive its energy from coal producing power plants, studies have found that even when this is so, electric vehicles would still reduce emissions by 22 per cent.

Additionally, according to Sherry Boschert, author of Plug-in Hybrids, the use of electric cars would reduce smog forming pollutants by as much as 32 and 99 per cent.

So what are the other tax implications and benefits of ULEVs?

Fully electric cars now enjoy a 5 per cent tax, which will move to up 9 per cent by 2018. Other ULEVs, such as plug-in hybrids and range extended vehicles, sit at a rate of 9 per cent, moving to 13 per cent by 2018.

George Osborne announced in March 2015 that tax increases shall rise more slowly from 2019-20. He said that this was: “To encourage a new generation of low emission vehicles we will increase their company car tax more slowly than previously planned, while increasing other rates by 3% in 2019-20.”

Although petrol and diesel engines must pay a Car Fuel Benefit Charge, this is not so for full electric cars as the Government does not consider electricity to be a fuel.

Claiming back money from your company

If you are an employee, and you happen to be reimbursed for your company travel, an employer will usually work out a pence-per-mile rate using the Government’s Advisory Fuel Rate (AFR). These are updated every quarter by HMRC, and calculated using current fuel prices and the average fuel efficiency of a car segment.

For those using ULEVs, the good news is that it is possible to receive the same rate as petrol or diesel cars (at the discretion of the employer), while enjoying lower running costs. Additionally, the money you receive is not taxable – it is yours to keep.

AFRs for plug-in hybrid and range extending electric vehicles are based on the size of a vehicle’s engine.

How to know if a green company car would suit your business needs

There are three primary questions that arise when it comes down to whether an electric car is right for your business:

- Does your premises have access to off-street parking?

- Is your daily mileage under 100 miles?

- Are you looking to buy a brand new car for your company?

Off-street parking is important so that a car can be charged either while it is at work or is at an employee’s home.

It is important for ULEVs that the daily driving mileage is below 100 miles per day so that the car can perform within the range required to get to and from work – with distance to spare for emergencies or a change of plan.

If you are interested in the best economical car for your business, take a look at our blog from August to see which cars are best suited for business needs.